When you start a new business you face a steep learning curve and it can feel overwhelming. Accounting may be one of the topics that are causing you confusion, so here are the accounting basics every entrepreneur should know to stay organised, reduce accounting fees and keep track of how your business is performing.

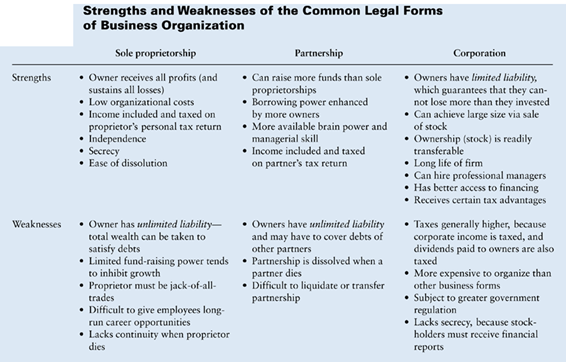

The first concept you should clarify is the strengths and weaknesses of the common legal forms of business organization:

Source: Marketing management / Daffodil International University

Cost Structure

Cost structure refers to the types and relative proportions of fixed and variable costs that a business incurs. The concept can be defined in smaller units, such as by product, service, product line, customer, division, or geographic region.

What are your most important costs?

In this section, we will develop how your company views costs and what costs it requires to operate. Below are two types of cost structures, reflect how your company chooses to utilize them:

• Value-Driven: Focus on improving high value propositions.

• Cost-Driven: Focus on reducing costs whenever possible.

There are many varieties of costs that can make up a Cost Structure, but the most important are:

• Fixed Costs – costs that remain the same despite the volume of goods or services produced (salaries, rents, etc.)

• Variable Costs – costs that vary proportionally with the volume of goods and services produced (utilities, material cost etc)

• Economies of Scale – cost advantages that a business enjoys as its output expands (larger companies benefit from lower bulk prices)

• Economies of Scope – cost advantage that a business enjoys due to a larger scope of operations (large companies can use the same marketing activities or distribution channels may support multiple products).

To fix the knowledge you have just acquired, we invite you to watch this video

Cash Flow

Cash flow is the difference in amount of cash available at the beginning of a period (opening balance) and the amount at the end of that period (closing balance). It is called positive if the closing balance is higher than the opening balance, otherwise called negative. Cash flow is increased by selling more goods or services, selling an asset, reducing costs, increasing the selling price, collecting faster, paying slower, bringing in more equity, or taking a loan.

Cash inflows are any receipts of cash to a business and can contain:

• payment for goods or services from your clients

• receipt of a bank loan

• interest on savings and investments

• shareholder investments

• tax returns

Cash outflows are any cash outgoings and can include:

• purchase of stock, raw materials or equipment

• wages, rents and daily operating expenses

• loan repayments

• income tax, payroll tax and other taxes

• asset purchases.

Why do you need to manage your cash flow?

• Be aware of short falls before they actually happen

• Better chance to stay on budget

• Can plan in advance for large purchases or low sales periods

• Shows you have an understanding of your business and situation

Watch the following video

Practicing your knowledge

Here you have an example of fix and variable cost, could you create your own grid with your product?

| Burger ingredients | Variable |

| Cooks’ wages | Fixed |

| Server’s wages | Fixed |

| Janitor’s wages | Fixed |

| Depreciation on cooking equipment | Fixed |

| Paper supplies (wrapping, napkins, and supplies) | Variable |

| Rent | Fixed |

| Advertisement in local newspaper | Fixed |