Why is financial management important?

Because a good financial management system enables you to accomplish important big picture and daily financial objectives. A good financial management system helps you become a better macromanager by enabling you to:

1. Manage proactively rather than reactively.

2. Borrow money more easily; not only can you plan ahead for financing needs, but sharing your budget with your banker will help in the loan approval process.

3. Provide financial planning information for investors.

4. Make your operation more profitable and efficient.

5. Access a great decision-making tool for key financial considerations.

Analysis of the internal environment.

There are thousands of different methods to help you analyse the internal environment of your company.

Here are some of the methods which can be used:

• Benchmarking helps you learn from other companies or organisations.

• The cost-benefit analysis considers and quantifies future benefits that are not only of a monetary character. It is a strong method which can depict the value of investment alternatives.

• A break-even analysis is a mathematical method to determine the quantity of production and sale that is necessary to gain profits. All of these methods have their advantages and are described briefly.

• SWOT deals with strengths and weaknesses of your company as well as with opportunities and threats posed by the external environment and it analyses the internal processes of company as well as external factors.

• The Balanced Scorecard allows managers to have a wider overview of an organization since it contains financial and non-financial measurements in a single report.

How can you implement Analysing Methods in your Company?

Strategic benchmarking involves 7 steps, and several of these steps can be run simultaneously:

Step 1: Identification of the benchmarking object

Step 2: Formation of a benchmarking team:

Step 3: Intern (Internal / interim) analysis of the benchmarking object

Step 4: Determination of the benchmark best practice case/company

Step 5: Analyses of the best practice case/company:

Step 6: Evaluation of results and analysis of outcomes

Step 7: Determination of new goals and processes and implementation of recommendations

Cost-benefit

The following four steps will help you to successfully undertake a cost-benefit analysis:

• Recording of costs: At first you have to collect all costs that result from all possible project / investment alternatives and write them down. Here you should also include follow-up costs and impacts on all departments of your company.

• Assessment of Benefits: In a second step you should consider all arguments in favour of each alternative. You should be able to derive the future benefit of the alternatives from the listed factors.

• Comparison of costs and benefits: In this step costs are contrasted with the benefits. If it is possible, assign a financial value to the benefits.

• Comparison of the alternatives: Depending on the results of the third step you have to estimate costs and justify the benefits by using 1 to 3 arguments. Thereafter you have to decide which one of the measures you will select.

How Can I use the cost-benefit analysis?

We invite you to watch this video to learn about this.

Break- even

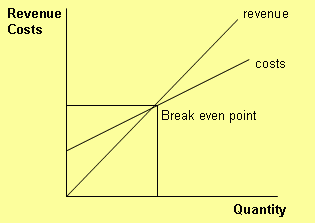

With the aid of break-even analysis you can find the point which separates the profit zone from the deficit zone. This point is called break-even point. For the break-even analysis you need the revenue, variable costs, the profit margin, fixed costs and the profits.

Now you can calculate:

• profit margin = revenue - variable costs

• Profit = profit margin - fixed costs

Now it is possible to draw a diagram:

Key rules for SWOT analysis

Identification of decisive success factors: It is very helpful for the strengths-weaknesses analysis to identify decisive success factors. This is an important task, but normally you know them and you can easily sketch them.

• Determination of strengths and weaknesses

• Determination of opportunities and risks

• Processing of the questionnaire and answering of key question

• In this step you should answer questions that mostly relate to the sector in which you are engaged.

• Deduction of strategic conclusions

SWOT ANALYSIS: How to perform one for your organization

To fix the concepts and learn how to perform a SWOT analysis of your company, watch this video!

Balanced Scorecard

The following steps will help you to develop a balanced scorecard:

• Ask yourself, what your visions and strategies are.

• Consider the success factors that can be identified and realized by using this strategy.

• Based on the success factors goals are formulated.

• These goals need to be measurable. For this purpose indicators (key figures) are identified. E.g. your profit.

• The last step is the most important one. You have to implement measures to achieve the target value of the key figure

How do I create The Balanced Scorecard? Watch the video.